Even though the transaction didn’t exchange any money, the value of the labor is subject to tax.Īccounting for goods and services can be complicated, and it would be best to keep records as accurate as possible on these transactions for tax purposes.

Many small business owners use the barter model to cover services like advertisements and related services. The bartering value would include the apartment’s property value market value and the value of the labor. The handyman would then include the fair market value of his rent and the property owner who allows the handyman to use his real estate in return for labor. When a business exchanges products/services with other businesses, the tax services will accept this as a transaction at fair market value.Īn example would be a handyman who provides his services to an apartment building in exchange for rent. When filling a gross receipt, you record bartered goods and services as well. In simple terms, you can trade a service or a good for a service or goods instead of a monetary exchange. The IRS defines bartering as an exchange of property or services between an entity and another entity and has special rules. What you’ve calculated is the entire amount your business receives from all sources during its Tax Year, without subtracting the Cost of Goods Sold or deductible expenses. Because of all the areas covered, you must be careful to record all of your receipts. Gather all of your invoices and receipts and then add all of the relevant and related sums.

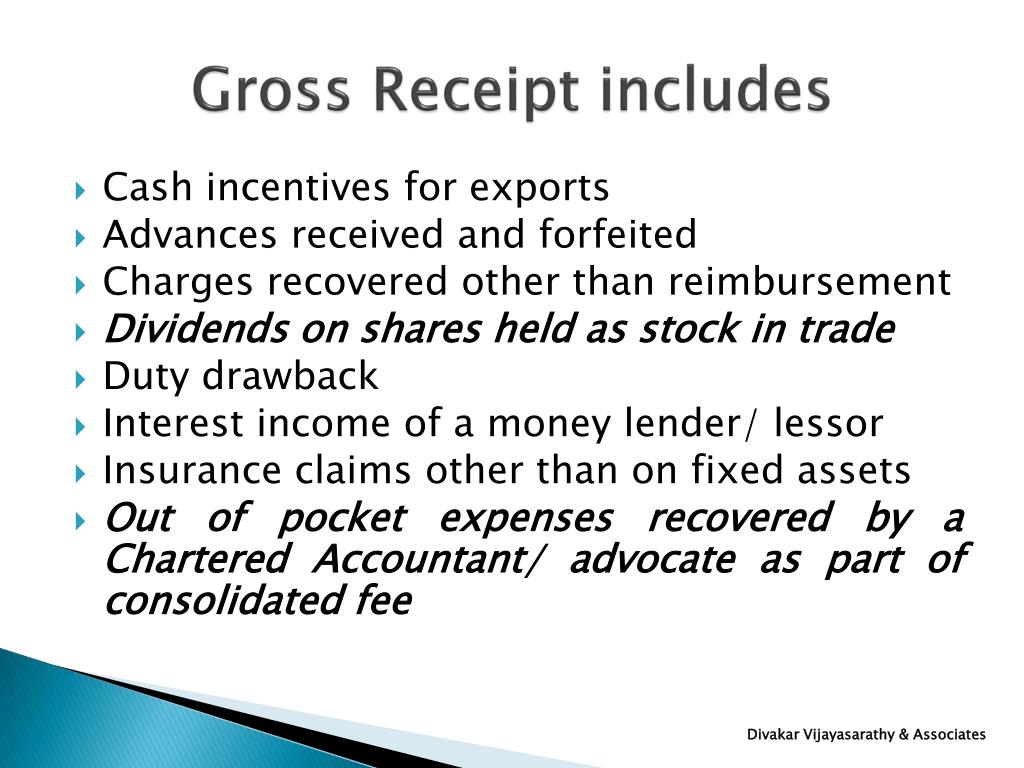

Royalties, fees, commissions, or any tax returns.When calculating gross receipts, start by establishing the time period that you want to cover, including money earned from: If you get paid for it, it counts towards your gross income calculations. Receipts of this kind include the entire amount of all receipts in cash or property without adjustment for expenses or other deductible items. Businesses calculate these monthly, quarterly, or yearly, depending on their organizational style.

0 kommentar(er)

0 kommentar(er)